400-076-6558智领未来,外贸超级营销员

400-076-6558智领未来,外贸超级营销员

400-076-6558智领未来,外贸超级营销员

400-076-6558智领未来,外贸超级营销员

Over the past two decades, the growth of foreign trade B2B enterprises has been almost inextricably linked to two types of platforms: B2B e-commerce platforms (such as Alibaba.com) and search engine platforms (represented by Google) . At a certain stage, they did indeed solve the problem of "where to find customers" and shaped the customer acquisition path for a generation of foreign trade enterprises.

However, as we enter 2026, an undeniable reality is emerging:

The platform's rules are highly opaque, and traffic allocation is uncontrollable.

Customer acquisition costs continue to rise, and ROI is being diluted.

Customer assets are held on the platform, not by the company itself.

AI search and recommendation are reshaping the procurement decision-making process.

The real risk is not that "the platform is not easy to use," but that the company has lost control over its customer acquisition system.

This article will systematically break down the issue from the perspective of corporate decision-makers:

Why is "platform dependence" becoming a structural risk for foreign trade B2B enterprises?

How does GEO (Generative Engine Optimization) break this dependency from its underlying logic?

How can foreign trade enterprises regain control of their customer acquisition capabilities in the era of AI recommendation?

Whether it's Alibaba, Google, or other third-party platforms, they are not essentially "customer acquisition systems" for businesses, but rather the platforms' own business systems . How much exposure a business can gain, what kind of customers it attracts, and under what conditions it is seen all depend entirely on the platform's algorithms, rules, and business strategies.

For businesses, this means:

You cannot control whether a customer sees you.

You cannot control how your customers perceive you.

You cannot accumulate complete customer perception and behavior data.

Once the rules change, all past investments may become invalid instantly.

Under the platform logic:

Products were displayed in a standardized manner.

The solution is compressed into a parameter comparison.

Corporate differentiation is difficult to perceive

There is usually only one final result:

Price competition + low-quality inquiries + decreased sales efficiency

This is not due to a lack of corporate capability, but rather because the platform mechanism is inherently unfavorable for expressing complex B2B decisions.

In platform mode:

Customers trust the platform first, not the company.

Businesses cannot fully grasp the customer decision-making process

Customers may be recommended to your competitors by the platform at any time.

In the long run, this is a structurally unsustainable customer acquisition model .

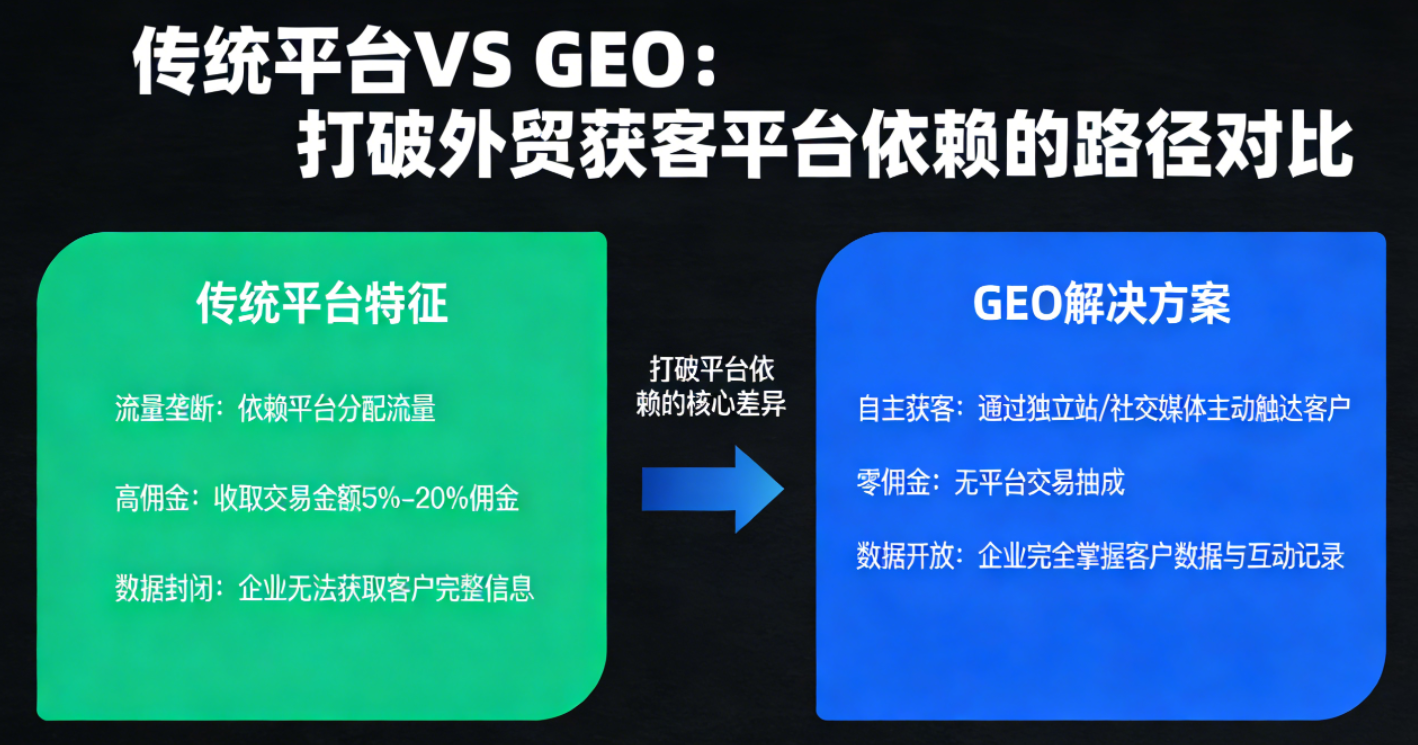

Below, we will conduct a comprehensive comparison between traditional platforms and GEO from the perspectives that are most important to enterprise decision-makers:

| Comparison Dimensions | Traditional platform model | GEO (Generative Engine Optimization) |

|---|---|---|

| Traffic attribution | The platform owns the rights, and businesses passively acquire them. | Enterprise content assets can be reused in the long term. |

| Recommendation Logic | Auction + Rules-driven | Semantic understanding + professional credibility |

| Customer perception | Look at the price, look at the rankings | See if it is "most suitable for solving the problem". |

| Differential expression | Extremely limited | It can systematically express products, solutions and capabilities. |

| Customer acquisition cost | Continued rise, uncontrollable | Initial construction costs decrease with diminishing marginal costs later on. |

| Customer quality | Primarily inquiry-based and comparison-based. | High interest, strong match |

| Data assets | Settled on the platform | wholly owned by the company |

| Risk resistance | Extremely low | Extremely high |

This is not a "tool upgrade," but a transfer of customer acquisition sovereignty.

With generative AI becoming the entry point for procurement information, customers are no longer just searching for keywords, but directly describing their needs to the AI:

Who can provide a solution suitable for a specific scenario?

GEO's core value lies in:

Let AI know exactly who you are

Define what problems you are good at solving.

Actively recommend you in the appropriate purchasing context.

This is a customer acquisition method that is completely different from traditional SEO and platform exposure.

GEO doesn't pile up keywords around a single product, but rather focuses on:

Industry Role

Application scenarios

Solution

Customer decision-making logic

Build an enterprise-level knowledge system so that AI can recognize you as:

A trusted solution provider in a specific niche market.

This is precisely the content format that complex B2B decision-making truly requires.

When customers access a company's website or content system through AI recommendations:

Corporate control of narrative

Brand, capabilities, and case studies are systematically understood.

Customers are more likely to enter into in-depth communication stages.

Customer acquisition is no longer about "grabbing traffic," but about "being selected."

GEO's real breakthrough lies in:

Not dependent on a single platform

Not bound by a single algorithm

Effective for all mainstream generative AI

By using structured content and semantic anchors, businesses can:

ChatGPT

Gemini

Claude

Perplexity

It is repeatedly and stably recommended in various AI scenarios.

This is a decentralized customer acquisition network, with enterprises as the central nodes.

For corporate decision-makers, the significance of GEO lies not in "replacing the platform," but in:

The platform will be downgraded from the "sole entry point" to a "secondary channel".

Build a long-term controllable customer acquisition infrastructure

Enhancing enterprises' resilience in the AI era

In practice, an increasing number of foreign trade enterprises are forming:

Platform customer acquisition + official website GEO + AI recommendation exposure + private domain conversion

A diversified customer acquisition structure.

History has proven this time and again:

The first wave of benefits belonged to foreign trade platforms.

The second wave of benefits belongs to search engines

The third wave of benefits belongs to independent websites.

The fourth category consists of companies that can be proactively recommended by AI.

The fourth Golden Window (GEO) has opened. How can foreign trade enterprises quickly seize this opportunity? What practical methods are available? This article provides insights: " How can foreign trade enterprises 'seize' AI recommendation slots and reap the benefits of the fourth Golden Window (GEO)? "

GEO is not an "optional" capability, but a fundamental capability that foreign trade B2B companies must develop in advance in the AI era.

Based on this underlying logic, systematic solutions focusing on foreign trade B2B scenarios and centered on enterprise knowledge structure and AI recommendation mechanisms have begun to emerge in the market. For example, ABke's Foreign Trade B2B GEO Intelligent Customer Acquisition Solution was created to help enterprises build long-term, sustainable, and independent customer acquisition capabilities without relying on platforms.

When the platform's initial benefits fade, what truly determines a company's future is whether it possesses its own "recommendation capability."

.png?x-oss-process=image/resize,h_100,m_lfit/format,webp)

.png?x-oss-process=image/resize,h_100,m_lfit/format,webp)

.png?x-oss-process=image/resize,h_100,m_lfit/format,webp)

.png?x-oss-process=image/resize,h_100,m_lfit/format,webp)

.png?x-oss-process=image/resize,h_100,m_lfit/format,webp)

.png?x-oss-process=image/resize,h_100,m_lfit/format,webp)